Expanding the consumer appeal of clubs, closer collaboration around data, and maintaining momentum behind the sector’s recovery were all on the agenda as fitness leaders gathered at FIBO 2022 in Germany at the start of April.

The return of the world's largest fitness trade show to a fully in-person format for the first time since 2019 marked a significant milestone in the industry’s COVID-19 recovery, as more than 500 exhibitors and 51,000 visitors from 109 countries converged to share ideas, showcase products and forge partnerships.

Here are eight standout themes from the trade show and discussion forums:

1. We’re not out of the woods yet

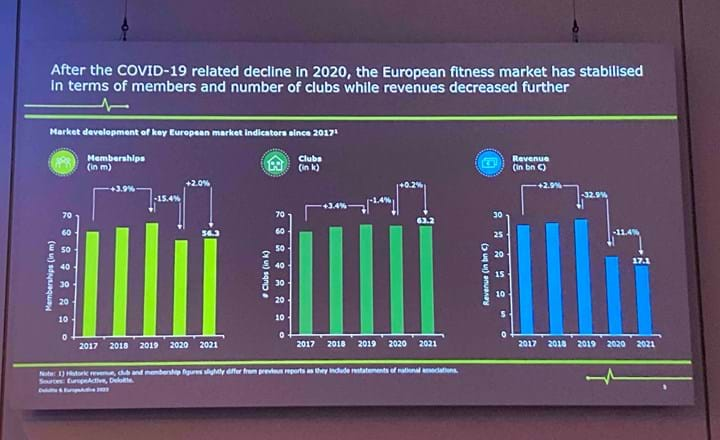

The publication of the European Health and Fitness Market Report 2022 at FIBO showed that – despite encouraging signs – the club market’s COVID recovery remains fragile and uneven.

Although 2021 marked a return to growth after a devastating 2020, the overall European market remains significantly below pre-pandemic levels in terms of clubs, members, and revenue. Large club chains are faring significantly better that smaller operators, while markets such as the UK are recovering faster than the likes of Germany, suggesting a complete recovery remains some way off.

The

report from

EuropeActive and Deloitte paints a stark picture of COVID’s impact on

European clubs and the rebuilding work still required.

A subsequent panel session on “The State of the Industry and 2022 Trends,” noted that innovation around the club offering and smarter personalisation can help operators to accelerate their recovery. Panelist Silje Garberg Ree from Scandinavian club chains SATS highlighted how digitalisation offers new opportunities for clubs, but also challenges.

“It’s not just about fitness clubs anymore,” she said. “The competition is really increasing. We have to broaden our scope, which will allow us to reach new clients.”

2. Fairer fitness for all

At a time when we’re experiencing a historic movement for racial justice, female leadership, equity and representation around the world, it’s never been more important for fitness to step up and play its part.

This momentum provides the opportunity to effect change in every industry, and for modern fitness brands, a clear commitment towards diversity, equity and inclusion (DEI) is shifting from a nice-to-have to a non-negotiable.

The progress fitness has made to date – and the substantial work still to be done – came under focus during the “Achieving Greatly: Inclusion in Action” panel session, with fitness leaders unanimous in the view that greater representation and inclusivity must be a top priority.

"Inclusion is about ensuring everyone has a seat at the table and feels empowered to be at their best without fear of failure," said Les Mills International CEO Clive Ormerod. He outlined some of the DEI initiatives Les Mills has implemented so far, stressing that education, measurement (using SMART goals) and accountability are essential for sustained progress.

3. How clubs can stay relevant

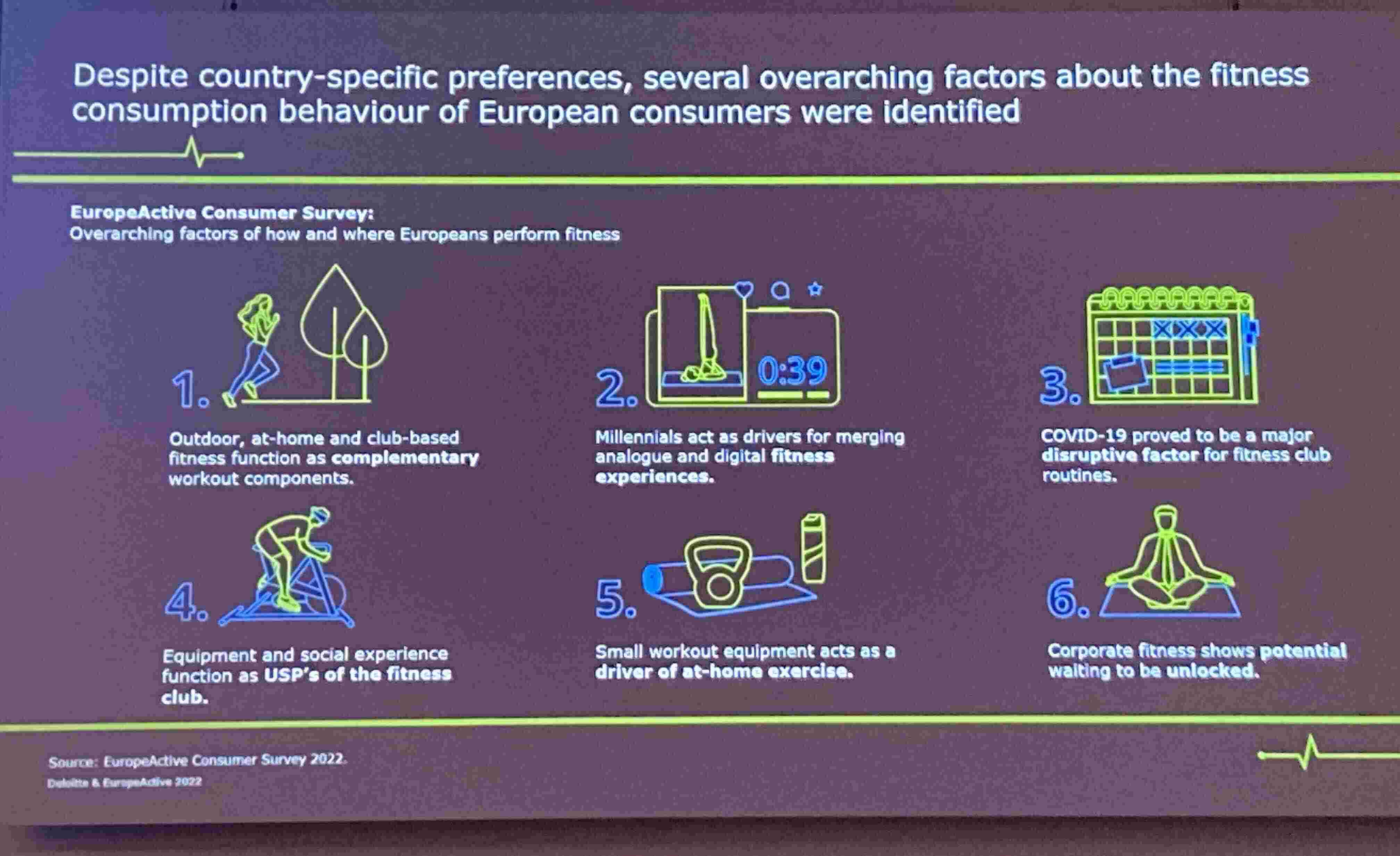

During their opening presentation on the findings of the European Health and Fitness Market Report 2022, EuropeActive Ambassador Herman Rutgers and Deloitte’s Karsten Hollasch illustrated the changing role for clubs in the eyes of consumers.

Based on insights from a recent survey of 11,000 European fitness consumers, they identified the presence of specialist equipment and the social experience of working out with others as the two standout USPs that clubs retain over other workout settings.

As markets have reopened, dialling up the social experience has been key to re-engaging members and building back better. How operators leverage these advantages and double down on creating a sense of community in their clubs and investing in member experience will be key to staying ahead in the post-pandemic fitness landscape.

4. Stars shine brighter amid labour shortage

With a global labour shortage starting to take its toll on all industries, operators will need to work increasingly hard to attract top talent in 2022 – and retain their existing star players.

This was a regular theme in discussions at FIBO 2022, along with other macroeconomic trends such as soaring inflation and shortages in the supply chain.

As highlighted in the EuropeActive report, the imperative for clubs to focus on social fitness experiences will see Instructors at the heart of these efforts, mixing hard and soft skills to bring enjoyment and results.

“If the pandemic was defined by our use of technology to keep members moving, then the next phase of club growth will undoubtedly be driven by our talent,” said Les Mills Europe CEO Martin Franklin in a panel session on how to engage consumers.

“Our people are the only competitive advantage that rival clubs can’t copy. Therefore, it’s our people – particularly Instructors – who will enable us to crack the code and unlock an unprecedented phase of post-pandemic club growth.

“With consumers now favouring a 60:40 blend between in-club and digital workouts, how we leverage and nurture our teams to bridge the gap between our in-club and digital offerings will have a major bearing on our future success.”

5. Betting on Boutiques

After a decade of dizzying growth, the pandemic proved particularly tough for boutique operators. With their reliance on office workers and prime city centre locations, boutiques were among the segments hit hardest – and the shift towards home-working continues to sting. But despite these setbacks, appetite for boutique experiences is higher than ever among consumers. This has sparked a surge in new partnerships between boutiques and big box operators, while lessons the wider club market can learn from boutiques – particularly in terms of pricing and member experience – was a constant theme at FIBO 2022.

TRIB3 CEO Kevin Yates noted that the flexibility boutiques afford the modern consumer is a key component of their appeal, meaning boutique operators can concentrate their focus on delivering an exceptional experience for each visit, versus being stuck on the ‘retention treadmill’.

And in a separate session, Phillip Mills highlighted how leading big box clubs are bringing boutique offerings into their facilities to attract younger audiences and negate the threat that nearby boutiques pose to their membership. Citing the success of Midtown Athletic Club in Chicago, which has already exceeded its pre-pandemic membership and is believed to be the most profitable club in the world, he advocated the importance of investing in new innovations to entice members back.

“We’ve all lost members over the past two years and need to grow numbers back as quickly as possible, which means doing new things to create excitement,” said Phillip Mills.

“During the depths of the global financial crisis, there were still people lining up outside Apple stores to buy the latest iPhone. That’s the level we have to aim for – new equipment, exciting new class concepts, boutiques inside our clubs, chic and dynamic décor – offers compelling enough to motivate people, whatever’s going on in the world.”

6. A broader future for fitness

With consumers taking a more holistic view of their health, exercise is being increasingly acknowledged as the cornerstone of living well – presenting significant opportunities for club growth.

The challenge for operators is to show how their services can contribute not just to people’s physical health, but also their mental and spiritual health in helping to tackle conditions that affect large sections of the population. This opens up exciting opportunities for how clubs can adapt their marketing to target different audiences. But as panellists Emma Barry, Ian Mullane and Andreas Paulsen pointed out in the “Future of the fitness consumer” session, consumers now call the shots and clubs need to embrace personalisation, digitalisation and innovation if they’re to stand out in a crowded marketplace.

“COVID-19 has made clear the strengths and weaknesses of our sector and the paradigm shifts that are needed to accelerate our growth — and one of them is our focus on the consumer and meeting their specific needs,” Paulsen said.

7. Gamification is going nowhere

The cultural convergence between fitness, fashion, music and entertainment is fuelling a new age of ‘exertainment’, sparking bold collaborations and innovative products.

One of the most exciting strands of this trend is fitness gamification, which is inspiring a new generation of immersive workouts where music, visuals, wearables and Instructors combine to offer participants an exhilarating fitness experience.

Gamification was one of the standout trends of the trade show, with a slew of fitness games and data-led wearables demonstrating their potential to dial-up exercise motivation and attract younger audiences.

Companies like Fit XR and Supernatural have made early headway in this space, while Les Mills has made waves by launching a BODYCOMBAT VR app that takes the world’s most popular martial arts workout into the metaverse for a thrilling gamified workout.

From a societal perspective, the potential for VR and the metaverse to transform gaming from a sedentary activity into a form of workout could have huge health implications, particularly among children and young people. And the rising tide of a more active society would lift all boats, including those of fitness facilities.

8. The case for data and demonstrating social value

Much of the discussion at FIBO focused on the role of data in the fitness industry, both as a means of enhancing the customer experience, but also in proving to policymakers the benefits that fitness providers bring to broader society.

Several experts noted how industry data on the safety and societal impact of gyms (or lack thereof in some cases) played a key role in determining the extent of COVID restrictions that governments imposed on gyms. In markets where stronger data was available, industry bodies were able to present a stronger case to policymakers and win vital concessions to keep clubs in operation.

To this end, Utku Toprakseven, Chief Product Officer at 4global, presented the latest progress around the European Data Hub. The flagship program aims to provide EuropeActive and partners with the data and insight to demonstrate the scale, impact, and value of the European health and fitness market, Toprakseven said.

Through the project, a digital ecosystem is being built to aggregate data from across the sector. The team are also developing common data standards to allow consistent analysis and reporting – enabling operators, national associations, and technology partners to demonstrate impact and advocate on behalf of the sector.

THE GAME HAS CHANGED AND SO HAVE THE RULES

Learn the new rules of fitness and how your club can win with the 2021 Global Fitness Report.

DOWNLOAD THE FINDINGS